Interactive Maps

More information coming soon.Mayor's Office

|

The Chief of Staff is responsible for leading key strategic initiatives for the Mayor, ranging from the City's annual Transitional Aid application, the 2020 Census, communications, government and private grant funding, and innovation/good governance efforts. Alongside the Business Administrator, she stewards the City's relationship with the oversight monitors from the New Jersey Department of Community Affairs. The Chief of Staff also helps lead regular cabinet meetings of the City's leadership team. |

|

|

The Office of Constituent Services manages efforts to address individual constituent concerns. Constituent Services also manages the Quality of Life Task Force, an inter-departmental group which goes into different neighborhoods of the city on a weekly basis to enforce city regulations, and the Green Team, a volunteer group which plans regular community clean-ups throughout Paterson. |

|

Michael Jackson - 1st Ward

|

| Michael Jackson First Ward Office: (973) 321-1250 |

Budget

The budget for the city is prepared by this division; after approval by the Mayor, the budget is submitted to the City Council for their review and approval.

Click Here to View Budget Documents

Accounts & Controls

Health

The Paterson Division of Health serves residents of Passaic County, primarily those in Paterson, Hawthorne, Haledon, North Haledon, Prospect Park, West Paterson, and Totowa.

Download Health Division's services brochure

Engineering

Paterson Restoration Corporation (PRC)

The PRC's mission is to create opportunities for Paterson businesses - including equipment loans, relocation loans, or property development loans. The PRC enables businesses to grow and relocate to the city of Paterson.

Board Members: (Updated 2024)

| NAME | TITLE | EXP TERM |

| Orlando Cruz | Chairman Class C | Permanent |

| Steven Rose | Member Class B / Vice-Chair | 12/31/2026 |

| Tiffany Harris- Delaney | Executive Director | Permanent |

| Harvey Nutter | Member Class B / Treasurer | 13/31/2024 |

| Mario Tommolilo | Member Class B | 12/31/2026 |

| Matt Evans | Member Class B | 12/31/2026 |

| George Mcloof | Member Class B | 12/31/2026 |

| Abdul Hamdon | Member Class B | 12/31/2025 |

| Dipto Roy | Admin | Adminstrative |

| Linton Gaines | Member Class B | 12/31/2025 |

| Jabeen Ahmed | Member Class B | 12/31/2025 |

| Robert Belmont | Member Class A | 13/31/2024 |

| Derya Taskin | Member Class A | 12/31/2024 |

| Jada Fulmore | Member Class B | 12/31/2025 |

| Rocio Pena | Member Class B | 12/31/2024 |

| Kenneth Rosado | Member Class A | 12/31/2024 |

| Latrese Verdina | Admin | |

| Barbara Testin | Accountant | |

| Tom Cangiolosi | Counsel | |

| Jamie Dykes | Advisor |

Fire Division

|

The Paterson Fire Division, under the command of Chief Alex Alicea, works to prevent and combat the destructive forces of fire. The Fire Headquarters at 300 McBride Avenue is a 27,000 square foot state of the art facility that opened in 2015.

Learn more about the history of the Paterson Fire Division dating back to 1815 at the Paterson Fire History page.

|

Chief Alex Alicea |

Parades

Public Meetings

The City of Paterson is governed by a Mayor and Nine (9) City Council Members. Use the links below for more information on the governing body and their meetings.Announcements

Shahin Khalique - 2nd Ward

|

| Shahin Khalique Second Ward Office: (973) 321-1250 |

Paterson Alcohol Beverage Control Board

Commissioners

|

Last Name |

First Name |

Title |

| Briggs | James |

Commissioner |

| Baralt | Melissa |

Commissioner |

| Campusano | Frank |

Commissioner |

Liquor License Annual Renewal Seminar

Scheduled for

Thursday, April 8, 2021 11:00AM - 1:00PM

will be Virtual

Those who wish to register for the Paterson Licensee Training Session

can click on the link below

https://attendee.gototraining.com/r/5227757090865018881

After registering you will receive a confirmation email

containing details about joining the training.

Please contact us at 973-321-1300 with any questions or concerns.

Information Technology

- Production of tax bills;

- Maintenance for all accounting records;

- Technical assistance in the operations & upgrading of the business software and hardware.

Tax Assessor

The main function of the Tax Assessor's Office is the appraisal and evaluation of all land and buildings within the municipality for tax purposes, according to state statutes. Additional duties include maintaining property transfers, keeping current ownership updated, checking building permits that have been issued and maintaining current values.The Tax Assessor approves applications for Veteran, Senior Citizen and Disabled Deductions and total tax exemption applications for Disabled Veterans and non-profit organizations.

The Tax Assessor prepares the Added and Omitted Assessment List that includes all new construction that has been completed within the tax year, and represents the Borough in all tax appeals before the Passaic County Board of Taxation and the Tax Court of New Jersey.

Deductions & Exemptions

If you are a qualified Veteran, Surviving Spouse/Domestic Partner of a Veteran, Senior Citizen, Disabled Person or Surviving Spouse of a Senior Citizen or Disabled Person, you may be eligible for a property tax deduction that would reduce your tax liability. You can request an application form for any of the below listed deductions or exemptions from the Tax Assessor's Office, or you can download the application in PDF format by choosing the appropriate link below.Veterans & Surviving Spouse/Domestic Partner

An annual $250 deduction from property taxes is available for the property of a qualified Veteran or Surviving Spouse/Domestic Partner of a Veteran. In order to be eligible the applicant must be an owner of the property and citizen and resident of New Jersey as of October 1 of the pre-tax year and the Veteran must have been honorably discharged or released from active service in the US Armed Forces during one of the following periods:| Mission or Operation | Time Period Served |

| Operation Northern/Southern Watch*

|

August 27, 1992 - March 17, 2003

|

| Operation Iraqi Freedom*

|

March 19, 2003 - Ongoing

|

| Operation Enduring Freedom*

|

September 11, 2001 - Ongoing

|

| Joint Endeavor/Joint Guard*

|

November 20, 1995 - June 20, 1998

|

| Restore Hope Mission*

|

December 5, 1992 - March 31, 1994

|

| Operation Desert Shield/Desert Storm*

|

August 2, 1990 - February 28, 1991

|

| Panama Peacekeeping Mission*

|

December 20, 1989 - January 31, 1990

|

| Grenada Peacekeeping Mission*

|

October 23, 1983 - November 21, 1983

|

| Lebanon Peacekeeping Mission*

|

September 26, 1982 - December 1, 1987

|

| Vietnam Conflict

|

December 31, 1960 - May 7, 1975

|

| Lebanon Crisis of 1958*

|

July 1, 1958 - November 1, 1958

|

| Korean Conflict

|

June 23, 1950 - January 31, 1955

|

| World War II

|

September 16, 1940 - December 31, 1946

|

| World War I

|

April 6, 1917 - November 11, 1918

|

* Peacekeeping Missions require a minimum of 14 days service in the actual combat zone except where service incurred injury or disability occurs in the combat zone, then actual time served, though less than 14 days, is sufficient for purposes of property tax exemption or deduction. The 14 day requirement for Bosnia and Herzegovina may be met by service in one or both operations for 14 days continuously or in aggregate. For Bosnia and Herzegovina combat zone also includes the airspace above those nations.

You can request an application from the Tax Assessor's Office, Claim Form V.S.S., which can be filed with the Assessor or Collector. Additional proofs required for a veteran include a copy of the Honorable Discharge or Release, Form DD214. A surviving spouse/domestic partner must also include a copy of the veteran's death certificate.

If you are a Veteran or Surviving Spouse/Domestic Partner of a Veteran who served during a Peacekeeping Mission you must also submit the Supplemental Form for Peacekeeping Missions, Supplemental D.V.S.S.E/V.S.S.

Senior Citizen, Disabled Person or Surviving Spouse

An annual $250 deduction from property taxes is available for the property of a qualified senior citizen, disabled person or surviving spouse who meet certain income requirements. Senior Citizen, Disabled Person and Surviving Spouse are defined as follows:

Senior Citizen - Age 65 or more as of December 31 of the pre-tax year.

Disabled Person - Permanently and totally disabled as of December 31 of the pre-tax year.

Surviving Spouse - Age 55 or more as of December 31 of the pre-tax year and at the time of death of person receiving Senior Citizen or Disabled Person Deduction.

In addition to the requirements set forth above, the applicant must be an owner and resident of the home as of October 1 of the pre-tax year and a New Jersey resident one year prior to that date and a yearly income less than $10,000 excluding Social Security Income and Disability Benefit Income or certain public pensions, which ever is more.

You can request an application from the Tax Assessor's Office, Claim Form PTD, which can be filed with the Assessor or Collector. Additional proofs include proof of age and an Income Statement. The Tax Assessor may also require an applicant to furnish a copy of their most recent Income Tax Return.

Property Tax Exemption for 100% Disabled Veterans or Surviving Spouse/Domestic Partners

Certain permanently and totally disabled war veterans or the surviving spouses/domestic partners of such disabled war veterans are granted a full property tax exemption on their dwelling house and the lot on which it is situated.In order to qualify, you must be an honorably discharged veteran, who had active service in time of war in the U.S. Armed forces (dates), or the unmarried surviving spouse/domestic partner of such a disabled veteran. Surviving spouses of servicepersons who died in active service during a time of war also qualify. The veteran must be certified as 100% permanently and totally disabled by the United States Veteran's Administration.

Applicants must also be the owner as well as a permanent resident in the dwelling and a legal resident of the State of New Jersey to qualify. In the case of surviving spouses/domestic partners, the deceased spouse/partner must also have been a legal resident of New Jersey.

You can request an application from the Tax Assessor's Office, Claim Form D.V.S.S.E., which can be filed at any time during the year with the Assessor. Additional proofs required for a veteran include a copy of the Honorable Discharge or Release, Form DD214 and the Veterans Administration Certification of Disability. A surviving spouse/domestic partner must also include a copy of the veteran's death certificate.

If you are a Veteran or Surviving Spouse/Domestic Partner of a Veteran who served during a Peacekeeping Mission you must also submit the Supplemental Form for Peacekeeping Missions, Supplemental D.V.S.S.E/V.S.S.

Tax Appeals

Taxpayers who disagree with their property's assessment have the right to appeal to the Passaic County Board of Taxation on or before April 1 or 45 days from the date the Assessment Notifications are mailed by the taxing district, whichever is later. Appeal forms can be requested from the Passaic County Board of Taxation, or can be downloaded in PDF format below:If the property is assessed for more than $1,000,000.00 the taxpayer can appeal directly to the N.J. State Tax Court. If you are dissatisfied with the judgment of the Bergen County Board of Taxation, you may file an appeal with the N.J. State Tax Court within 45 days from the date of the final judgment.

Added & Omitted Assessments

Added Assessments

New Construction, structural additions and improvements completed after October 1 are valued and taxed under the Added Assessment Law. This way property that becomes accessible after October 1 does not avoid its fair share of the tax burden for the rest of the year.A new structure, or an addition to or alteration of an old structure, is valued as of the first day of the month following completion. If the value when completed is greater than the assessed value placed on the structure on October 1 of the pre-tax year, an Added Assessment based on the difference must be made. The Added Assessment is prorated on the number of full months in the tax year.

Omitted Assessments

Additional assessments that through error, were not made at the proper time, may be placed on the tax rolls through the Omitted Assessment Laws. An Omitted Assessment can be made for the current year of discovery and one prior year.Tax bills for both Added and Omitted Assessments are generally sent in October and are payable on November 1. If you disagree with the Added or Omitted Assessment that is placed on your property, you can appeal it to the Passaic County Board of Taxation prior to December 1. An appeal form can be requested from the Passaic County Board of Taxation or downloaded in PDF format, Added/Omitted Petition of Appeal.

Financial Empowerment Center (FEC)

The Paterson Financial Empowerment Center (FEC) offers professional, one-on-one financial counseling as a FREE public service to help residents achieve financial stability and long-term success.

Our dedicated financial counselors are here to help you overcome financial challenges, plan for your future, and gain control over your finances. Whether you're looking to improve your credit score, manage debt, or build a budget, we're here to support you every step of the way.

How We Can Help:

• Create a budget and prioritize spending

We’ll work with you to develop a realistic budget based on your income and expenses. This includes identifying essential costs, cutting unnecessary spending, and setting aside funds for savings and debt repayment. The goal is to help you take control of your finances and make informed decisions.

• Dispute incorrect credit report items

If there are errors on your credit report (such as incorrect personal information, fraudulent accounts, or inaccurate payment records), we’ll guide you through the process of filing disputes with the credit bureaus and ensuring your report reflects accurate information.

• Legacy Planning

Our counselors can help you create a legacy plan to protect your assets and ensure financial security for your family and future generations. This includes setting up wills, trusts, and beneficiary designations, as well as discussing options for estate planning and inheritance to safeguard your family's future.

• Open a bank account and increase savings

We can help you choose the right type of bank account that suits your financial needs, whether it’s a checking or savings account. Our counselors will also work with you to create a savings plan, set financial goals, and build an emergency fund to prepare for unexpected expenses.

• Research and apply for government benefits

Our team will help you identify and apply for local, state, and federal benefits you may qualify for, such as food assistance (SNAP), housing support, Medicaid, and tax credits. We’ll ensure you understand the eligibility requirements and assist with the application process.

• Resolve credit card and other debts

Our financial counselors will work with you to assess your current debt, including credit cards, personal loans, and other outstanding balances. We’ll help you create a repayment plan, negotiate with creditors if necessary, and explore options to reduce interest rates or consolidate debts to make payments more manageable.

• Understand and improve your credit score

We’ll review your credit report with you, explain the factors that affect your score (like payment history, credit utilization, and account age), and provide actionable steps to help you improve your score over time. This may include setting up automatic payments, reducing debt balances, and responsibly using credit.

Locations and Co-Locations where you can have an in-person session with one of our counselors:

Main-Location: NJCDC New Jersey Community Development Corporation

Located at: 13 1/2 Van Houten Street, Paterson, NJ 07505

Office Hours: MON-FRI 9:00am-4:00pm

Phone: 973-413-1655

Co-Location: Department of Health & Human Services

Located at: 125 Ellison Street, 1st Floor Paterson, NJ 07505

Office Hours: MON and WED 9:00am-4:00pm

Phone: 973-321-1242

Co-Location: OASIS

Located at: 9 Mill Street Paterson, New Jersey 07501

Office Hours: MON and WED 9:00am-3:00pm

Phone: 973-881-8307

For further information about the Paterson FEC, please contact:

Paterson FEC at (973) 413-1655 or

Department of Health & Human Services at (973) 321-1242 Ext. 1024

Daysiling Vargas, Local Government Manager

For new clients please click on the link below: https://fecpublic.org/appointment-paterson

All returning clients please refer to this link below: https://fecpublic.org/portal-paterson

Traffic & Lighting

Urban Enterprise Zone (UEZ)

Police Division

The mission of the Paterson Police Division is to preserve the peace and to protect and serve all who live or work in, as well as those who travel through, our city and in so doing, make a meaningful contribution to the quality of life in our community.

For more information, visit the

Paterson Police website.

Restaurant Week

Upcoming Events

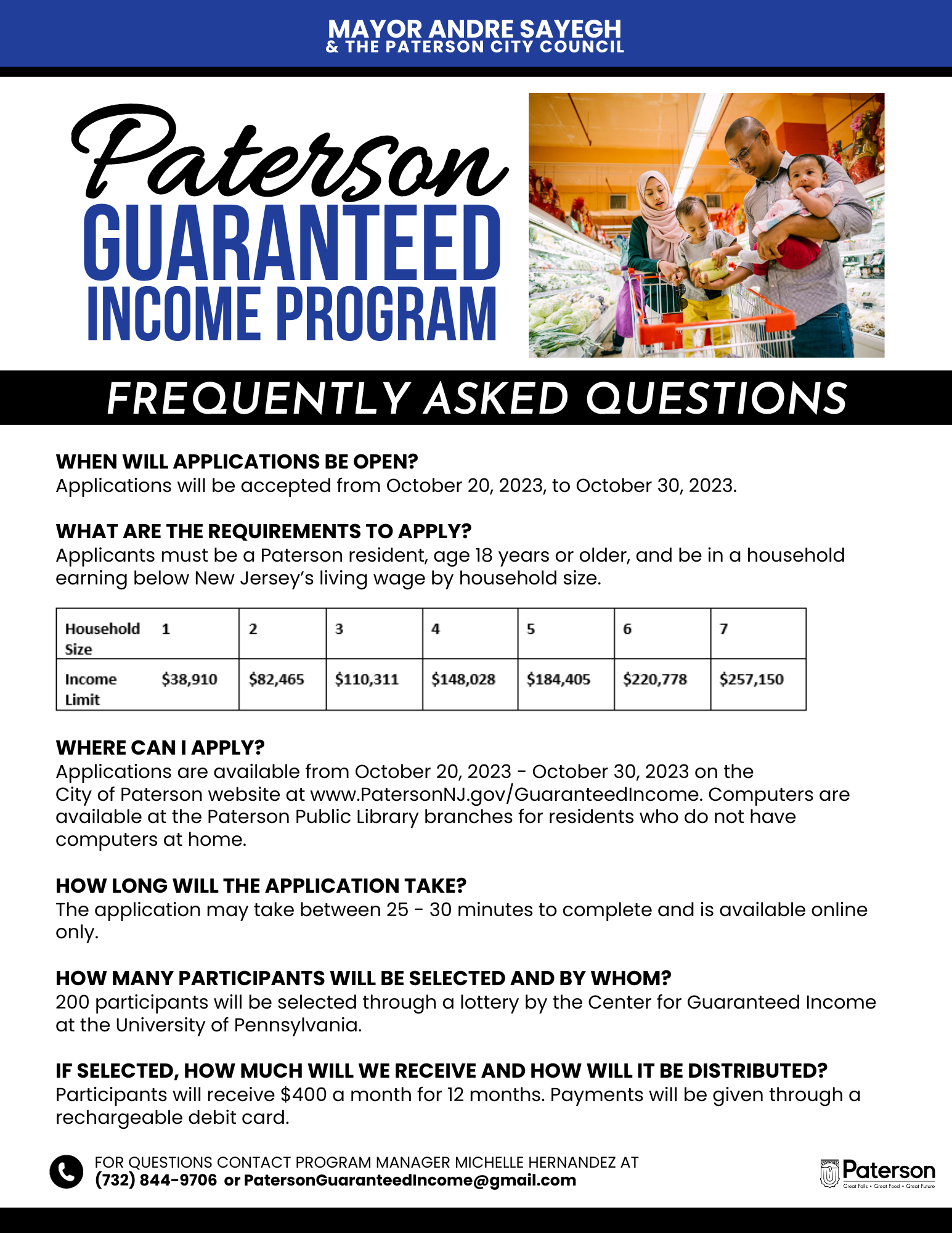

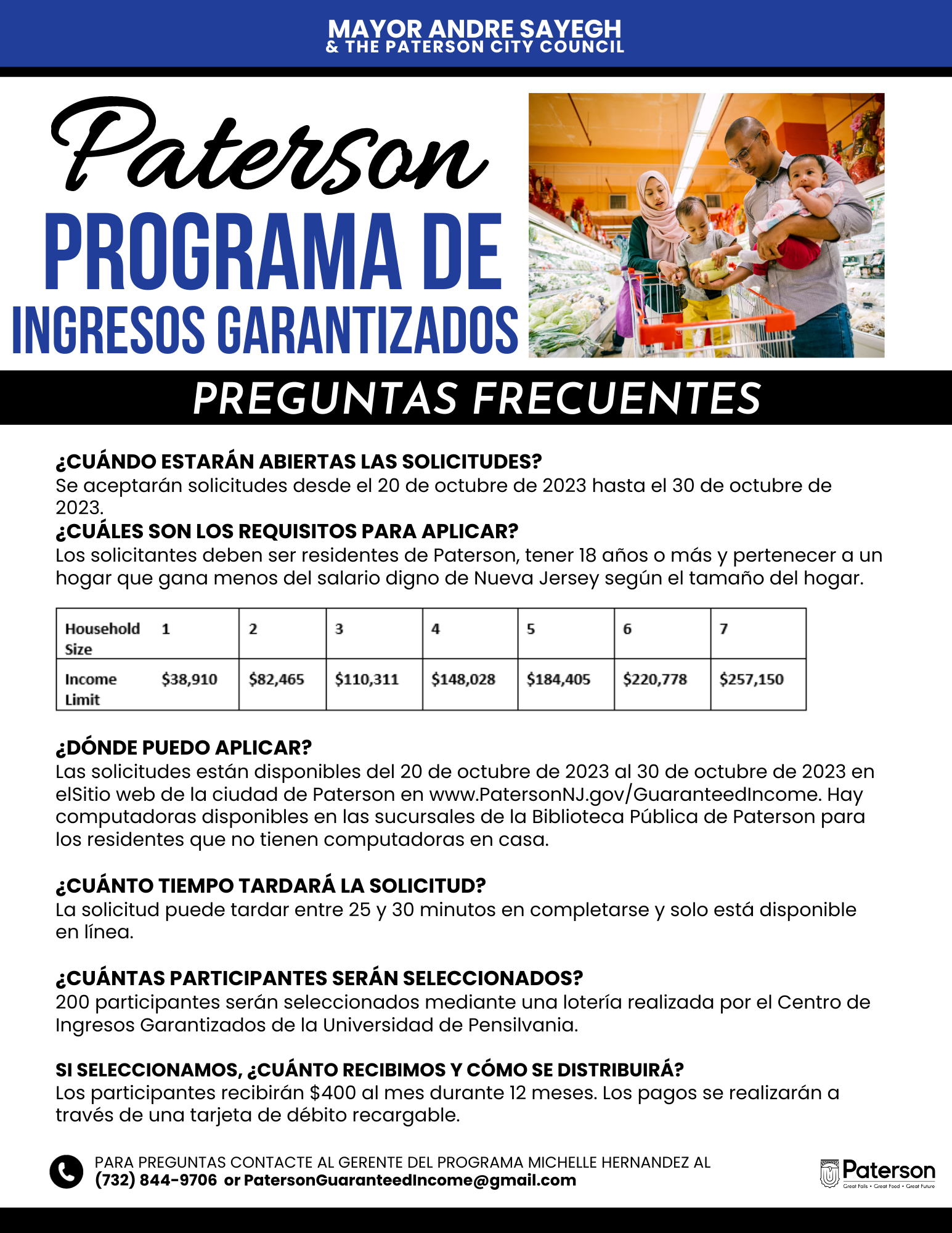

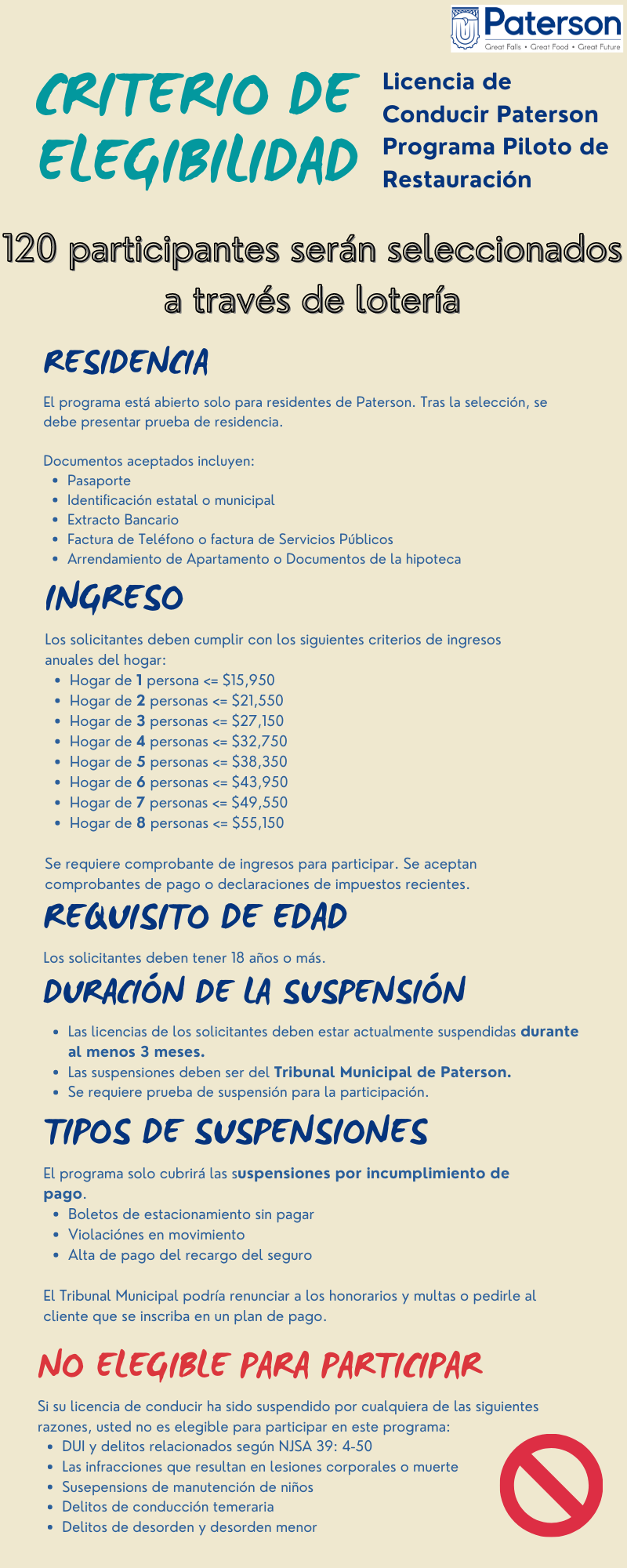

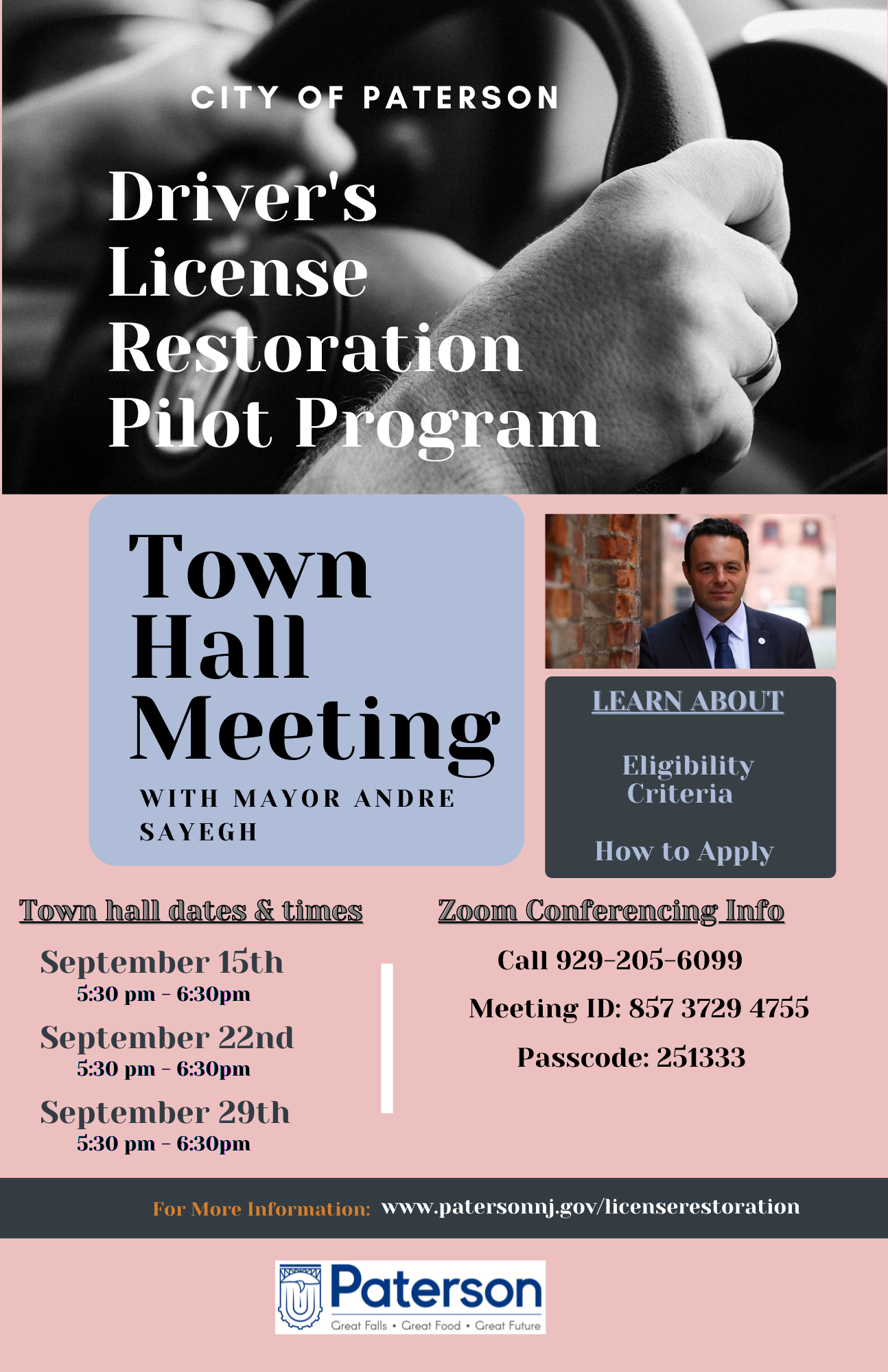

More information coming soon.Driver's License Restoration Program

Applications are now closed. Applicants will be notified about their application status by 10/29/2021.

Eligibility Criteria - License Restoration Program - Spanish

Eligibility Criteria - License Restoration Program - English

City of Paterson Driver's License Restoration Program - English Flyer

City of Paterson Driver's License Restoration Program - Spanish Flyer

Alex Mendez - 3rd Ward (Council President)

|

|

|

Alex Mendez |

Personnel

|

The Personnel Division for the City of Paterson is responsible for several components in keeping the City running smoothly.

Some of the processes we are responsible for include:

|

Internal Audit

Planning & Program Analysis

Our mission is to strengthen the Paterson community by enhancing the delivery of essential social services. Through these grants, we aim to support local initiatives that create, improve, and expand programs to better serve the citizens of Paterson.

The Office of Planning & Program Analysis provides comprehensive support to Paterson-based nonprofit and non-daycare organizations through the following services:

• Funding Support – Assistance with identifying and securing funding opportunities.

• Non-Profit Management – Guidance on effective management strategies to strengthen organizational performance.

• Program Monitoring Services – Oversight and evaluation to ensure successful program implementation and impact.

• Technical Assistance – Support with navigating complex regulatory, operational, and programmatic challenges.

CONTACT US

Daysiling Vargas, BBA

Program Monitor

(973) 321-1242 x 1024

Dvargas@patersonnj.gov

Sewer

Planning & Zoning

-

Administering and providing staff support to the Planning Board (PB) and the Zoning Board of Adjustment (ZB);

-

Processing, reviewing and commenting on development applications to the PB and ZB.

-

Evaluating Master Plan and Land Development ordinances.

-

Soliciting community input for development plans.

-

Providing information to the public and to regional planning agencies.

-

Enforcing decisions made by the Planning Board and Zoning Board of Adjustment.

-

Reviewing construction plans, permit applications and certificate of occupancy applications for zoning compliance.

Planning Board and Zoning Board of Adjustment Site Plan and Subdivision Application

For more information about the Division of Planning and Zoning, please consult our Fact Sheet.

Help for Businesses

Department of Economic Development

RESOURCE GUIDE FOR BUSINESSES IN THE CITY OF PATERSON AFFECTED BY COVID-19

(Click here to download and print resource guide.)

|

|

| Click here to complete the Emergency Assistance Eligibility Wizard created by the NJEDA to see whether you might qualify for state programs. |

| Click here for more detailed info for NJ businesses impacted by COVID-19 from NJEDA. |

| Click here to learn more about the Garden State Relief Fund from New Jersey Community Capital, which offers working capital loans to small businesses and nonprofits which have been disproportionately negatively impacted by this evolving public health crisis. |

The New Jersey Economic Development Authority (NJEDA)’s application for the next round of the Small Business Emergency Assistance Grant Program is now available. More info here: https://lnkd.in/d7cZrht

OVERVIEW OF RESOURCE GUIDE

The City of Paterson recognizes that COVID-19 pandemic presents an unprecedented economic challenge for many members of our business community. Thus, to ensure the resiliency of local businesses and to assist in job retention, the Department of Economic Development in the City of Paterson has compiled a master list of resources and information to keep small businesses informed on the most relevant information, best practices and resources to overcome the economic damages of COVID-19. (NOTE: this is a dynamic webpage and will be periodically be updated and edited as things develop)

The Department of Economic Development for the City of Paterson is conducting a survey on the impact of COVID-19 to local businesses. The data from this survey will be used to provide business owners with relevant information on loans and grant programs to support business operations during and after COVID-19 pandemic. To help us advocate for your business needs, please participate in this survey by CLICKING HERE TO ACCESS SURVEY.

If you have a question about how or where to find assistance, you can contact the City's Office of Economic Development or one of our partners:

| CITY OF PATERSON | Penni Forestieri |

Director - Division of UEZ Department of Economic Development |

Office: 973-321-1220 EXT: 2267 Cell: 201-249-1101 Email: pforestieri@patersonnj.gov |

| CITY OF PATERSON | Sikandar Khan |

Economic Development Representative Department of Economic Development |

Office: 973-321-1220 EXT: 1220 Email: Skhan@patersonnj.gov |

| PATERSON DOWNTOWN SPECIAL IMPROVEMENT | Orlando Cruz | District Manager | Office: 973-881-7302 Cell: 973- 200-4289 Email: ocruz@downtownpatersonsid.org |

| GREATER PATERSON CHAMBER OF COMMERCE | Jamie Dykes | President Greater Paterson Chamber of Commerce 100 Hamilton Plaza Suite 1201 Paterson, NJ 07505 |

Phone: 973-881-7300 |

| PASSAIC COUNTY ECONOMIC DEVELOPMENT | Deborah Hoffman |

Director |

Office: 973-569-4720 Mobile: 201-738-3039 deborahh@passaiccountynj.org |

|

WILLIAM PATERSON UNIVERSITY SMALL BUSINESS DEVELOPMENT CENTER (SBDC) |

Kate Muldoon |

Regional Director |

Office: 973-321-1378 www.sbdcwpu.com |

|

PASSAIC COUNTY ONE STOP CAREER CENTER |

Employment and Unemployment 200 Memorial Dr. |

Office: 973-742-9227 |

|

| NEW JERSEY BUSINESS ACTION CENTER HELPLINE | Hotline: 1-800- JERSEY-7 |

Federal Resources

- Small Business Administration (SBA) offers business assistance to impact businesses. SBA has approved New Jersey for SBA lending programs. Apply Online, FAQ’s, and Required Information

- Small Business Administration Disaster Loan Program offers $7 billion in low-interest loans to businesses, renters and homeowners located in regions affected by declared disasters.

- Small Business Administration Economic Injury Disaster Loans

- SBA Guidance for employers to plan and respond to COVID-19.

- Internal Revenue Services (IRS) is offering Federal Income Tax Extensions.

- Centers for Disease Control (CDC) offers interim guidance for businesses and employers to plan, prepare and respond to coronavirus.

- Department of Labor OSHA has guidance on Preparing Workplaces for COVID-19.

- S. Department of Commerce Economic Development Administration - Revolving Loan Fund Standard Terms and Conditions

Federal Grants and Loans - Additional Resources for Businesses

- Get to your lender, get to your lender, get to your lender. If the bank for your business is SBA approved, they will be able to make loans and, in some cases, grants to get immediate funding that you need. Especially for Paycheck Protection Loan and Emergency Bridge Loan.

- Connect with guides who can help guide you through applying - SCORE, SBDC, Center for Women in Enterprise, Veterans Outreach Center. See list of partners at end with contact info.

- For SBA funding, fastest way to get a decision is to apply online at http://disasterloan.sba.gov/ela. Applies to Economic Injury Disaster Loan, and 7(a).

- If a sole proprietor and not have payroll tax deduction can apply for Economic Injury Disaster Loan, 7(a), CDC/504, Express Bridge Loan.

|

Source |

Term / Rate |

Amount |

Decision |

|

SBA Economic Injury Disaster Loans (EIDL) |

30 years Max rate 4% 3.75% for business 2.75% for private nonprofits |

up to $2 million |

3-4 weeks from when completed application submitted, start here: https://disasterloan.sba.gov/ela/ |

|

SBA 7(a) |

Negotiable, cannot exceed SBA max |

up to $5 million |

5-10 business days |

|

SBA CDC/504 |

Current market rate for 5-year and 10-year U.S. Treasury issues |

Up to $5 million |

Varies depending on CDC |

|

SBA Express Bridge Loan |

7 years |

up to $25,000 |

Varies depending on lender |

|

Paycheck Protection Program |

10 years Max rate 4% |

up to $10 million |

|

|

Emergency Paid Sick Leave |

n/a |

|

Apr 1 - Dec 31 |

|

Family Medical Leave |

n/a |

|

Apr 1 - Dec 31 |

|

Unemployment insurance |

n/a |

$600/week Federal benefit State benefit varies by state |

|

|

CARES Act |

n/a |

$1,200 per adult and $500 per child |

April 6 to mid-May |

Details of Programs

SBA Economic Injury Disaster Loans (EIDL)

- For small businesses unable to obtain credit elsewhere

- Any business can apply, whether 30+ years old or just started this year

- Look at next 6 month and funding needed to run day-to-day operations

- Can apply for addition funding at a later time if needed

- 12 month deferral, first year not need to make a loan payment, though interest will accrue

- For loans under $25K, no collateral requirements

- Over $25K SBA will look to collateralize with personal or business assets

- State must declare disaster to be eligible

- For any owner 20% or will need a personal financial statement

- Provide estimated amount of loss, schedule of liabilities

- For loans over $500K will need business tax returns

- No obligation to sign note, can hold off signing six months

- If denied, have six months from the date of denial to submit request for reconsideration with additional supporting info

- No cost to apply

- Not care about lending position - not looking to take senior position, will take Jr, 3rd, 4th, and 5th

- Expedited access to capital for emergency grant of $10K in 3 days

- If apply for EIDL get $10K grant even if denied for EIDL to maintain payroll, paid sick leave, service other debts, rent

- Does not impact other loans, particularly Paycheck Protection Program

- Loan program is available to all small businesses, not just employers

SBA Express Bridge Loan

- To get short term financing now

- Helps with same issues as EIDL loan

- Small loan of up to $25K

- May have application fees depending on bank

- Can only go through a bank that currently a customer of, not brand new account

- Bank needs to be an Express Lender with an Express Authority Agreement with SBA

- Does not limit ability to apply for an EIDL, can use EIDL to pay off Express Bridge Loan

- Banks are making funding decisions based on their own lending practices, SBA not making decision

SBA 7(a)

- Primary program for providing financial assistance to small businesses

- Lenders not required to take collateral for loans up to $25,000

- For loans in excess of $350,000, the SBA requires the lender collateralize the loan to the maximum extent possible up to the loan amount

- Because 7(a) not specific to COVID-19, new loans can be applied for on top of the 7(a)loan program

SBA CDC/504

- Economic development loan program that offers small businesses another avenue for business financing, while promoting business growth and job creation

- Long-term fixed-rate financing to acquire fixed assets for expansion or modernization

- Available through Certified Development Company (CDC)

- Must be used for fixed assets (and certain soft costs), including:

- The purchase of existing buildings

- The purchase of land and land improvements, including grading, street improvements, utilities, parking lots and landscaping

- The construction of new facilities or modernizing, renovating or converting existing facilities

- The purchase of long-term machinery

- The refinancing of debt in connection with an expansion of the business through new or renovated facilities or equipment

Current SBA Loan Holders

- SBA will pay principal and interest for six months

Paycheck Protection Program

- Use to cover payroll cost: salary, wage, payment of cash/tips, commissions, paid sick leave and family leave, paid vacation, health care cost, retirement contributions, retired leave, any state and local payroll tax

- All counts towards maximum amount of what get as a loan

- Basically, any money that spend to maintain an employee, including the business owner if on payroll

- For businesses in business as of 2/15/2020

- Total earnings for any one individual cannot exceed $100,000 when figuring out maximum loan amount

- Maximum loan is 250% of average monthly payroll, provisions if just started

- Start off as a loan

- Loan can be used for payroll, rent, mortgage payment, utilities, to keep lights on and employees working

- Payment deferred for a year - not have to pay for serving loan at all

- Gets cash flow to businesses so they can get back up and running, and restored to before pandemic levels

- For businesses that have already laid off employees, can use money to hire employees back to pre-crisis levels

- Administered by banks and credit unions, not SBA

- Federal fees are waived

- No personal or business guarantee required - not need to pledge loan or collateral

- If money used for payroll costs as defined, loan can be forgiven for first eight weeks

- If maintain payroll through June, including self (many small business owners are on payroll), will be able to get this loan forgiven

- Government giving cash flow to keep business open, be able to get forgiven and not pay back

- If confident can keep all or most employees on payroll, this is a loan/grant worth looking at

- Sliding amount of forgiveness based on what percent of employees able to maintain

- After first eight weeks can use loan for expenses through June 30, 2020

- No penalty for prepay of loan

- In first six months if prepay can do so before interest kicks in

- When apply for grant ask for emergency cash advance of $10,000

- Must certify under perjury that believe could qualify for the loan

Emergency Paid Sick Leave and Expanded Family Medical Leave

- Emergency Paid Sick Leave, 10 days that employers required to give workers who qualify for leave if they sick and present symptoms, have a child who is sick with COVID-19

- Day 11 to 12 weeks, all employers under 500 employees required to have family medical leave available

- Refundable tax credits against payroll tax available to small business

- Available to access as quickly as possible to limit disruption of employees taking paid sick leave or expanded FMLA

- Emergency Paid Sick Leave and Expanded Family Medical Leave take effect April 1 through end of year. If another occurrence, employer still under obligation.

- Hardship exemption for employers less than 50 employees for portions of emergency paid sick leave and expanded FMLA. Not exempt employers from everything.

Unemployment Insurance

- If self-employed, independent, gig worker - never before able to qualify - are eligible now

CARES Act

- $1,200 per adult, $500 per child for those with $75,000 individual income or $150,000 filing jointly

- Single parents max is $136,500

- Coming as a one-time grant between Apr 6 and mid-May

- Speaker Pelosi considering another cash grant

- Will send by direct deposit with numbers gave for tax return

- If not direct deposit, will send by mail

FEDERAL LEGISLATION

- R. 6074 (Coronavirus Preparedness and Response Supplemental Appropriations Act)

- R. 6201 (Families First Coronavirus Response Act) Additional Stimulus Package

Internal Revenue Service (IRS) IRS.GOV

Paid Relief for Workers Small and midsize employers can begin taking advantage of two new refundable payroll tax credits designed to immediately and fully reimburse them, dollar-for-dollar, for the cost of providing COVID-19-related leave to their employees. This relief to employees and small and midsize businesses is provided under the Families First Coronavirus Response Act (Act).The act gives businesses with fewer than 500 employees funds to provide employees with up to 80 hours of paid leave, either for the employee’s own health needs or to care for family members. There are two credits available:

Paid Sick Leave Credit For an employee who is unable to work because of COVID-19 quarantine or self-quarantine or has COVID-19 symptoms and is seeking a medical diagnosis, eligible employers may receive a refundable sick leave credit for sick leave at the employee's regular rate of pay, up to $511 per day and $5,110 in the aggregate, for a total of 10 days (up to 80 hours)

For an employee who is caring for someone with COVID-19, or is caring for a child because the child's school or child care facility is closed, or the child care provider is unavailable due to COVID-19, eligible employers may claim a credit for two-thirds of the employee's regular rate of pay, up to $200 per day and $2,000 in the aggregate, for up to 10 days (up to 80 hours). Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Child Care Leave Credit In addition to the sick leave credit, for an employee who is unable to work because of a need to care for a child whose school or child care facility is closed or whose child care provider is unavailable due to COVID-19, eligible employers may receive a refundable child care leave credit. This credit is equal to two-thirds of the employee's regular pay, capped at $200 per day or $10,000 in the aggregate. Up to 10 weeks of qualifying leave can be counted towards the child care leave credit. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Using the Credits Under guidance that will be released next week, eligible employers who pay qualifying sick or child care leave will be able to retain an amount of the payroll taxes equal to the amount of qualifying sick and child care leave that they paid, rather than deposit them with the IRS.The payroll taxes that are available for retention include withheld federal income taxes, the employee share of Social Security and Medicare taxes, and the employer share of Social Security and Medicare taxes with respect to all employees.

If there are not sufficient payroll taxes to cover the cost of paid qualified sick and child care leave, employers will be able file a request for an accelerated payment from the IRS. The IRS expects to process these requests in two weeks or less. The details of this new, expedited procedure will be announced next week.

NEW JERSEY STATE RESOURCES

Various New Jersey State agencies are currently working with local business leaders, local financial institutions, and business advocacy groups to ensure impactful support that ensures business and employment continuity. The resources listed below are non-exhaustive. Please keep checking this page for the most up to date information.

- New Jersey Pandemic Relief Fund (NJPRF) to Fight COVID 19

- Looking to hire? OVID-19 On-Demand Hiring Intake Form

- Looking for work?

- Employers Association of New Jersey EZ Pay Chart to help businesses navigate NJ Mandated Benefits and to find out which laws apply

- Sick Leave Benefits for Employees and Business Compensation

- State of New Jersey Website Devoted to COVID-19 Business Concerns

- File for Unemployment Insurance

- Women’s Center for Entrepreneurship Corporation

- Veterans Outreach Center

OUT OF WORK DUE TO COVID- 19? HERE’S HOW TO FILE UNEMPLOYMENT INSURANCE IN NJ

Visit www.nj.gov/labor or www.covid19.nj.gov for more information about who is eligible and if your situation would allow you to collect unemployment insurance.

Frequently Asked Questions:

What is unemployment insurance?

Workers who lose their jobs through no fault of their own and meet eligibility requirements may receive benefits for up to 26 weeks in a one-year period. The benefits are meant to partly replace wages while people are looking for work. The money comes from a payroll tax paid by employers and workers.

Who is eligible?

If your business closed or your hours are reduced due to the coronavirus, you may be eligible for benefits. Visit New Jersey's unemployment page to understand if you meet the requirements.

To apply online, you must have:

- Worked only in New Jersey in the last 18 months, or

- Worked in New Jersey and any other state(s) in the last 18 months, or

- Worked for the federal government and in New Jersey in the last 18 months, or

- Served in the military in the last 18 months and be physically present in New Jersey

How much could I earn?

You can use this calculator to estimate how much you can get each week on the Department of Labor site here. In 2020, workers could earn up to 60% of their average weekly wage, up to $713 a week. The federal government is negotiating a package that would add $600 a week for unemployment payments for four months on top of state payments.

What information do I need to apply?

- Social Security Number or Alien Registration Number (if you are not a U.S. citizen)

- Pension information if you are receiving any pension or 401(k)

- Amount and duration of any separation pay you may be receiving

- Recall date (if you expect to be recalled to your job)

- Union hiring hall information, including local number and address (if you get work through a union)

- Military Form DD-214 (if you were in the military in the last 18 months)

- Form SF-8 or SF-50 (if you were a federal employee)

- Complete name and address of employer

- Employer's telephone number

- Your occupation with that employer

- Beginning and ending dates of employment

- Reason for separation

I am a freelancer or gig economy worker. Am I eligible?

While these workers are typically not eligible, a stimulus bill being weighed in the U.S. Congress will extend benefits to cover part-time workers, freelancers and gig economy workers. It still needs to be passed by the House and signed by President Donald Trump.

If I am denied, can I appeal my claim?

Yes, you can appeal a denial here: https://bit.ly/2UlSVNN

How do I apply?

Make sure you understand if you qualify for benefits first, or it may take longer for you to receive other benefits that better fit your situation, labor department officials say.

You can apply a new claim for unemployment insurance here: bit.ly/2WMQ6H0

Are there any jobs in the state available?

Yes. The state created a job portal at jobs.covid19.nj.gov for essential companies like grocery stores and delivery services. Companies like InstaCart, Amazon, UPS and Hackensack Meridian Health have postings on the site. Murphy said there were more than 35,000 openings for about 300 companies as of Thursday.

What other benefits are available?

New Jersey also offers paid sick leave, family leave and workers compensation, among other things. Learn more about these programs at covid19.nj.gov.

What if I am sick?

Earned sick leave

Full- and part-time employees in New Jersey earn up to 40 hours of paid sick time that they can use to if they are sick, to care for family members, to stay home if their workplace is closed due to a public health emergency or if their child's day care or school is closed for public health reasons. Workers can carry over up to 40 hours of sick leave to the following year, and earn one hour of paid sick leave for every 30 hours they work. An employee can start using hours after 120 days of work, but a company can advance the time.

Temporary disability

If you contracted the virus, but not at work, you can file a claim online at myleavebenefits.nj.gov.

Workers compensation

If you contracted COVID-19 at work, such as while interacting with a co-worker with the virus, or serving someone at a restaurant who was infected, you may be eligible for workers' compensation insurance. For more information,

visit www.nj.gov/labor/wc/workers/claim/filing_index.html.

What if someone in my family is sick?

New Jersey workers can earn up to six weeks of paid time off to care for a sick family member. They can earn up to two-thirds of their paycheck, or up to a maximum of $667 a week. Starting July 1, 2020, workers will get 12 weeks of paid time off and will be able to earn up to 85% of their weekly wages up to $881 a week.

You can also use earned sick leave.

Reported by Ashley Balcerzak in the New Jersey Statehouse

NEW JERSEY ECONOMIC DEVELOPMENT AUTHORITY (NJEDA) RESOURCES

New Jersey Economic Development Authority (NJEDA) has a portfolio of loan, financing, and technical assistance programs available to support small and medium-sized businesses. It has approved a suite of new programs designed to support businesses and workers facing economic hardship due to the outbreak of the novel coronavirus COVID-19.

- Small Business Emergency Assistance Grant Program – A $5 million program that will provide grants up to $5,000 to small businesses in retail, arts, entertainment, recreation, accommodation, food service, and other services – such as repair, maintenance, personal, and laundry services – to stabilize their operations and reduce the need for layoffs or furloughs.

- Small Business Emergency Assistance Loan Program – A $10 million program that will provide working capital loans of up to $100,000 to businesses with less than $5 million in revenues. Loans made through the program will have ten-year terms with zero percent for the first five years, then resetting to the EDA’s prevailing floor rate (capped at 3.00%) for the remaining five years.

- Community Development Finance Institution (CDFI) Emergency Loan Loss Reserve Fund – A $10 million capital reserve fund to take a first loss position on CDFI loans that provide low interest working capital to micro businesses. This will allow CDFIs to withstand loan defaults due to the outbreak, which will allow them to provide more loans at lower interest rates to microbusinesses affected by the outbreak.

- CDFI Emergency Assistance Grant Program – A $1.25 million program that will provide grants of up to $250,000 to CDFIs to scale operations or reduce interest rates for the duration of the outbreak.

- NJ Entrepreneur Support Program – A $5 million program that will encourage continued capital flows to new companies, often in the innovation economy, and temporarily support a shaky market by providing 80 percent loan guarantees for working capital loans to entrepreneurs.

- Small Business Emergency Assistance Guarantee Program – A $10 million program that will provide 50 percent guarantees on working capital loans and waive fees on loans made through institutions participating in the NJEDA’s existing Premier Lender or Premier CDFI programs.

- Emergency Technical Assistance Program – A $150,000 program that will support technical assistance to New Jersey-based companies applying for assistance through the U.S. Small Business Administration. The organizations contracted will be paid based on SBA application submissions supported by the technical assistance they provide.

- NJEDA COVID-19 Website- NJEDA has created a webpage that directs business owners to various resources to assist in coping financially with the COVID-19 public health crisis. This site will be updated with any new programs or support that becomes available. The programs have been copy-pasted below CLICK HERE TO ACCESS THE LINK.

NATIONAL RESTAURANT RELIEF

New Jersey Community Capital: GARDEN STATE RELIEF FUND

NEW JERSEY MANUFACTURING EXTENSION PROGRAM

- NJMEP set up an email hotline, takeaction@njmep.org. Use this hotline to ask your questions or voice your concerns.

- Disaster Management Planning Services. Crisis Management or Business Continuity

- How has your supply chain fared during the COVID-19? Be part of the solution by filling out this form: Supply Chain Preparedness Support

- Download the Exemption Template Letter for manufacturers that run a 2nd and/or 3rd shift. Download Exemption Template Letter

NJ BUSINESS ACTION CENTER

- Website: NJ Business Action Center

- Covid19 Business updates, website: business.nj.gov

- Help Line 1-800-jersey-7 open from 8AM – 9PM 7 DAYS A WEEK

STATE LEGISLATION

PRIVATE SECTOR RESOURCES FOR FIRMS AND BUSINESSES

- Garden State Relief Fund from New Jersey Community Capital

- Facebook Small Business Grants Program

- JPMorgan Chase Makes $50 Million Philanthropic Investment to Help Address Immediate and Long-Term Impacts of COVID-19

- List Of Banks Offering Relief To Customers Affected By COVID-19.

- The Restaurant Workers’ Community Foundation formed a COVID-19 Emergency Relief Fund for small businesses and their restaurant workers, and is accepting donations.

- Kiva is urging small businesses to apply for 0% interest loans up to $15,000. The company is also offering a longer grace period: new borrowers can access a grace period of up to 6 months.

- Kabbage launched an online hub to help boost sales for U.S small businesses impacted by COVID-19, including a system through which businesses can sell gift cards to consumers for use at a later date.

- GoFundMe has partnered with Yelp to allow independent businesses to start fundraisers and accept donations through Yelp’s pages.

Great Falls Festival

Citizen Alert Sign Up

Get alerted about emergencies and other important community news by clicking on the button below to sign up for our Notification System. This notification system enables the City to provide you with critical information quickly in a variety of situations, such as severe weather, unexpected road closures, missing persons, and evacuation of buildings or neighborhoods.Events

Ruby Cotton - 4th Ward

|

| Ruby Cotton Fourth Ward Office: (973) 321-1250 |

Purchasing

|

The Purchasing Agent is responsible for procuring supplies, materials and services for all departments in a manner the promotes fair and competitive bidding, compliance with To secure a copy of a Bid, Request for Proposal, or a written quote choose one of the following: |

Harry M. Cevallos, QPA, R.P.P.S Harry M. Cevallos, QPA, R.P.P.SPurchasing Agent |

-

Documents may be secured by coming to the Division of Purchasing and request a copy of the desired documents.

-

Fax your request to 973.321.1341, requesting a copy of the desired documents. Required information: Bid Number, Commodity Description, Opening Date. With your company's Name, complete address, contact person, telephone, fax number.

Housing Division

Mercantile Licensing

The City Ordinance requires Paterson businesses to register & obtain Mercantile License. This licensing process improves our ability to protect consumers. The inspector assists with ensuring the following:

- Ensures Consumer Protection

- Provides Technical Assistance to Businesses

Facilities

Paterson Planning Board

City Of Paterson

PLANNING BOARD

PLANNING BOARD MEETING CALENDAR JUL 2023-JUNE 2024

Planning Board and Zoning Board of Adjustment Site Plan and Subdivision Application

City of Paterson Zoning Map

For more Information call

NAME |

TITLE |

TERM EXPIRATION |

E-MAIL ADDRESS |

|

Janice Northrop |

Chairperson |

7/1/23 - 6/30/27 |

|

|

Fannia Santana |

Vice Chairperson |

7/1/20 -6/30/24 |

|

|

Kobir Ahmed |

Commissioner |

7/1/22-76/30/26 |

|

|

Badrul Hassan |

Commissioner |

7/1/20- 6/30/24 |

|

|

Mark Fischer |

Commissioner |

7/1/21 - 6/30/25 |

|

|

Imran Hussain |

Commissioner |

7/1/22 - 6/30/25 |

|

|

Pedro Liranzo |

Commissioner |

7/1/23-6/30/24 |

|

|

Frankie Roman |

Commissioner - Alternate #1 |

7/01/22- 6/30/24 |

|

|

Zoraya Ammar |

Commissioner - Alternate #2 |

7/1/23 - 6/30/25 |

|

|

Delbres Claudio |

Mayor's Representative |

7/01/23 - 6/30/24 |

|

|

Shahin Khalique |

Council Representative |

||

| Michael Deutsch | Principal Planner | mdeutsch@patersonnj.gov | |

| Solmaz Farzboud | Board Planner | sfarzboud@patersonnj.gov | |

| Alfred V. Acquaviva, Esq | Board Attorney | aacquaviva@avalawyers.com | |

| Mayra Torres-Arenas | Acting Board Secretary | mtorres@patersonnj.gov |

Help for Individuals

State of NJ Covid-19 Portal

Ask your coronavirus questions here, and check your symptoms with the symptoms tracker.

State of NJ Jobs Portal for Essential Businesses

From grocery stores to shipping/logistics companies, click below to see who's hiring.

https://jobs.covid19.nj.gov/index.html

How to Apply for Unemployment Due to COVID19:

https://myunemployment.nj.gov/labor/myunemployment/covidinstructions.shtml

Mortgage Payment Relief

Governor Phil Murphy announced a 90-day grace period for mortgage payments amid the coronavirus outbreak. A press release from Gov. Murphy's office also noted that there will be no negative credit impact from the relief as well as a 60 day moratorium on foreclosures and evictions. For more information please click here.

-The New Jersey Housing & Mortgage Finance Agency's Small Landlord Emergency Grant Program is accepting applications for its second round. The program reimburses landlords for missed/reduces rent as a result of COVID-19

(Click Image for more information. )

Luis Velez - 5th Ward

|

| Luis Velez Fifth Ward Office: (973) 321-1250 |

Public Defender

The Public Defender provides defense of indigent clients in the Paterson Municipal Court.

Revenue Collection

Municipal Alliance Prevention Program (MAPP)

The Municipal Alliance Prevention Program (MAPP) is a collaborative effort between the Governor's Council on Substance Use Disorder (GCSUD), City of Paterson Department of Health & Human Services (DHHS), and a diverse group of community partners.

The Alliance Committee consists of leaders from the school system, law enforcement agencies, social service agencies, mental health, faith based, residents and the business community. All the partners are dedicated to developing and implementing educational programs with an emphasis on alcohol & substance use prevention.

• Alliance Committee

• Collection of Data

• Measurable Program Effectiveness

• Policy Recommendations

• Program Funding Opportunity

• Training and Workshops

• Youth Leadership Committee

FOR MORE INFORMATION EMAIL jschutte@patersonnj.gov

OR CALL (973) 321-1242

Other Resources:

|

Alcoholics Anonymous |

1-800-245-1377 |

|

|

Al-Anon/Alateen North Jersey |

973-744-8686 |

|

|

Families Anonymous |

1-800-736-9805 |

|

|

Narcotics Anonymous |

1-800-992-0401 |

|

|

National Hopeline Network |

1-800-394-HOPE |

|

|

National Runaway Safeline |

1-800-RUNAWAY |

|

|

National Suicide Prevention Hotline |

1-800-273-TALK |

|

|

NJ Domestic Violence Hotline |

|

1-800-572-SAFE |

Paterson Free Public Library & Paterson Museum Board of Directors

|

Last Name |

First Name |

Title |

Term Commences |

Term Expires |

| Boone | Pauline |

Commissioner |

12/08/11 |

Open Term |

| Garcia-Leon | Maribel |

Commissioner |

3/09/09 |

12/31/13 |

| Sterling | Irene |

Commissioner |

1/01/11 |

12/31/16 |

| Mathis | Carla L. |

Commissioner |

1/01/11 |

12/31/16 |

| Taskin | Derya |

Commissioner |

1/01/11 |

12/31/16 |

| Vacant | ||||

| Vacant | ||||

| Vacant |

Auto Maintenance

Paterson Zoning Board of Adjustment

City of Paterson

ZONING BOARD OF ADJUSTMENT

BOARD CALENDAR JUL 2023-JUNE 2024

For more Information call

(973) 321-1343 Ext. 2349

NAME |

TITLE |

TERM EXPIRATION |

E-MAIL ADDRESS |

|

Joyed Rohim |

Chairperson |

7/1/20 - 6/30/24 | |

|

Yunior Fermin |

Vice Chairperson |

7/1/20 - 6/30/24 | |

|

Hector Baralt |

Commissioner |

7/1/21 - 6/30/25 | |

|

Trenace Barbee Watkins |

Commissioner |

7/1/21 - 6/30/25 | |

|

Karina Minauro |

Commissioner |

7/1/20 - 6/30/24 | |

|

Robert W. Parchment |

Commissioner |

7/1/22 - 6/30/25 | |

|

Charlene White |

Commissioner |

11/18/21 - 6/30/24 | |

|

Mohammad M. Alam |

Commissioner - Alternate #1 |

7/1/22- 6/30/24 | |

|

Osvaldo Vega |

Commissioner - Alternate #2 |

7/1/23 - 6/30/25 | |

| Michael Deutsch | Director of Planning & Zoning | mdeutsch@patersonnj.gov | |

| Gary Paparozzi | Board Planner | pmsurvey2@verizon.net | |

| Marco A. Laracca, Esq | Board Attorney | mlaracca@bioandlaracca.com | |

| Mayra Torres-Arenas | Board Secretary | mtorres@patersonnj.gov |

Help for Seniors

Recent News

- Zoning Permit ApplicationZoning Permit Application

- Seniors Farmers' Market Nutrition ProgramClick above for more details on the 2025 Seniors Farmers' Market Nutrition Program; Available starting May 1,...

- NOTICE OF HYBRID REASSESSMENT/REVALUATION PROGRAMThe City of Paterson is starting a citywide Hybrid Reassessment/Revaluation of all properties. This process w...

- Live Stream

April 8, 2025

City Council MeetingClick Above to Access the Live Stream of the City Council Meeting @ 6:30PM | Also viewable on Optimum Channel... - 04-03-25 ZONING BOARD OF ADJUSTMENT REGULAR MEETING AGENDA04-03-25 ZONING BOARD OF ADJUSTMENT REGULAR MEETING AGENDA

Upcoming Events

- Regular Meeting04/15/257:00 pm - 11:59 pm

- Planning Board Meeting04/23/256:30 pm - 11:59 pm

- Karachay Flag Raising 202505/03/2512:00 pm - 1:00 pm

- Karachay Flag Raising 202505/03/2512:00 pm - 1:00 pm

- Workshop Session - Approval of Expenditures & Disbursements05/13/256:30 pm - 11:59 pm

In this Department

Contact Us

Paterson, NJ 07505

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1600

- Fax:

(973) 321-1555 - Staff Directory

- Hours: Monday - Friday

8:30am - 4:30pm

Contact Us

Paterson, NJ 07505

Contact Us

- Phone: (973) 321-1370

- Staff Directory

- Hours: Monday - Friday

9:00AM - 4:30PM

Contact Us

- Phone: (973) 321-1212

- Fax:

(973) 321-1202 - Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1350

- Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1242

- Fax:

(973) 321-1224 - Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

- Staff Directory

- Hours: Monday - Friday

9:00AM - 4:30PM

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1310

- Staff Directory

- Hours: Monday - Friday 8:30am - 4:30pm

Contact Us

Court Administrator

Paterson, NJ 07505

- Phone: (973) 321-1515

- Staff Directory

- Hours: Monday - Friday

8:30am - 4:30pm

Contact Us

- Staff Directory

- Hours: Monday - Friday 9:00am - 4:30pm

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1260

- Staff Directory

- Hours: Tuesday - Friday 10 AM - 4 PM

Saturday - Sunday 12:30 - 4:30 PM

Closed Holidays & Mondays

Contact Us

Paterson, NJ 07501

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1488

- Staff Directory

- Hours: Monday - Friday

9:00AM - 4:30PM

Contact Us

- Assistant: (973) 321-1600

- Staff Directory

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

- Phone: (973) 340-4300

- Fax:

(973) 340-5598 - Staff Directory

Contact Us

Contact Us

Contact Us

Contact Us

- Phone: (973) 321-1310

- Staff Directory

- Hours: 8:30 a.m.- 4:30p.m.

Contact Us

Director, Historic Preservation

- Business Fax:

(973) 321-1356 - Business: (973) 321-1220

- Staff Directory

- Hours: Monday through Friday

8:30 AM to 4:30 PM

Contact Us

Contact Us

Paterson, NJ 07505

- Phone: (973) 977-3999

- Fax:

(973) 977-8039 - Staff Directory

Contact Us

Mayor

Contact Us

- Phone: (973) 321-1343 x 2346

- Staff Directory

- Hours: Monday thru Friday

Contact Us

Mayor

Contact Us

Secretary

Contact Us

Contact Us

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1343 x 2349

- Staff Directory

- Hours: Monday to Friday

8:30 A.M. TO 4:30 P.M>

Contact Us

- Phone: (973) 321-1600

- Staff Directory

- Hours: Monday to Friday

8:30 - 4:30

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1323

- Fax:

(973) 321-1325 - Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

- Staff Directory

- Hours: Monday - Friday

9:00AM - 4:30PM

Contact Us

- Phone: (973) 321-1340

- Fax:

(973) 321-1341 - Staff Directory

- Hours: Monday - Friday

8:30 A.M. - 4:30 P.M.

Contact Us

Paterson, NJ 07505

- Business: (973) 321-1200

- Staff Directory

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1232

- Staff Directory

- Hours: 8:30AM - 4:30PM

Contact Us

, 07505

- Phone: (973) 321-1212

- Staff Directory

- Hours: 8:30 a.m. - 4:30 p.m.

Monday- Friday

Contact Us

Physical Address

125 Ellison St4th Floor - Planning Board & Zoning Board of Adjustment Offices

Paterson, NJ 07505

- Business: (973) 321-1343

- Staff Directory

- Hours: Monday-Friday

8:30 a.m. - 4:30 p.m.

Contact Us

Director, Historic Preservation

- Business: (973) 321-1220

- Staff Directory

- Hours: Monday thru Friday 8:30 AM - 4:30 PM

Contact Us

Paterson, NJ

- Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

Health Officer

Paterson, NJ 07505

- Phone: (973) 321-1277

- Fax:

(973) 321-1246 - Staff Directory

- Hours: 8:30 AM - 4:30 PM

Contact Us

- Phone: (973) 321-1242 x 1024

- Fax:

(973) 321-1224 - Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

Director

- Phone: (973) 321-1242 x 2418

- Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

Paterson, NJ 07524

- Phone: (973) 653-5932

- Staff Directory

- Hours: Monday - Friday

7:30AM - 3:30PM

Contact Us

Paterson, NJ

- Business: (973) 321-1264

- Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

Paterson, NJ

- Fax:

(973) 321-1224 - Phone: (973) 321-1242 x 2285

- Staff Directory

- Hours: Monday - Friday

9:00AM - 4:00PM

Contact Us

, 07505

- Phone: (973) 321-1242

- Staff Directory

- Hours: Monday - Friday

9:00AM - 4:00PM

Contact Us

Paterson, NJ 07502

- Phone: (973) 321-0541

- Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

Paterson, NJ 07505

- Phone: (973) 279-9587

- Fax:

(973) 279-0587 - Staff Directory

- Hours: Monday-Friday 9AM-5PM Seasonal Weekend Hours: Saturday/Sunday 12:30-4:30PM

Contact Us

Paterson, NJ 07505

- Phone: (973) 321-1313

- Fax:

(973) 321-1314 - Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

Paterson, NJ 07505

- Phone: (973) 279-9587

- Staff Directory

- Hours: Monday - Friday

9:00AM - 5:00PM

Seasonal Weekend Hours 12:30 - 4:30 PM

Contact Us

Director of Economic Development

- Business: (973) 321-1220

- Business Fax:

(973) 321-1356 - Staff Directory

- Hours: Monday thru Friday

8:30 AM - 4:30 PM

Contact Us

Director, Urban Enterprise Zone

Contact Us

Contact Us

- Phone: (973) 881-3640

- Staff Directory

- Hours: Monday - Friday:

7:30AM - 7:30PM

Saturday - Sunday:

8:30AM - 3:30PM

Contact Us

Paterson, NJ 07501

- Business: (973) 321-1400

- Staff Directory

- Hours: Monday - Friday

9:00AM - 4:30PM

Contact Us

Paterson, NJ 07502

- Assistant: (973) 321-1111

- Staff Directory

- Hours: Monday - Friday

9:00AM - 4:30PM

Contact Us

OEM Coordinator

Paterson, NJ 07501

- Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

- Fax:

(973) 321-1224 - Business: (973) 321-1242 x 1024

- Staff Directory

Contact Us

- Business: (973) 321-1600

- Staff Directory

- Hours: Monday - Friday

8:30AM - 4:30PM

Contact Us

Paterson, NJ 07505

- Business: (973) 321-1549

- Business Fax:

(973) 321-1548 - Staff Directory

- Hours: Monday - Friday

8:30 AM - 4:30 PM

Contact Us

- Staff Directory

- Hours: Monday - Saturday

8:30AM - 6:00PM

Sunday

8:30AM - 2:00PM

Contact Us

- Business: (973) 321-1600

- Staff Directory

Contact Us

- Business: (973) 321-1572

- Staff Directory